Most sales pros think their job ends when the deal is signed. But if you don’t understand how those deals affect your company’s bottom line, you’re selling blind.

When I studied accounting in college, I didn’t realize how useful it would be later on as a solopreneur. But now? It’s helped me price projects more confidently, negotiate with more context, and understand exactly how much a “yes” is worth.

You don’t need a finance degree to sell smarter. But you do need a grasp of a few key accounting concepts like profit margins, cash flow timing, and cost structures. Once you connect the dots between what you sell and what the business keeps, your role becomes a whole lot more strategic. Let’s walk through the key concepts.

Table of Contents

- Accounting Fundamentals

- How to Set Up Your Small Business Accounting System

- The Importance of Accounting in Sales

- Essential Accounting Concepts

- Accounting Principles for Sales Success

- Essential Financial Documents

- Accounting Skills for Sales-Led Professionals

- How to Integrate Accounting With CRM Systems

Accounting Fundamentals

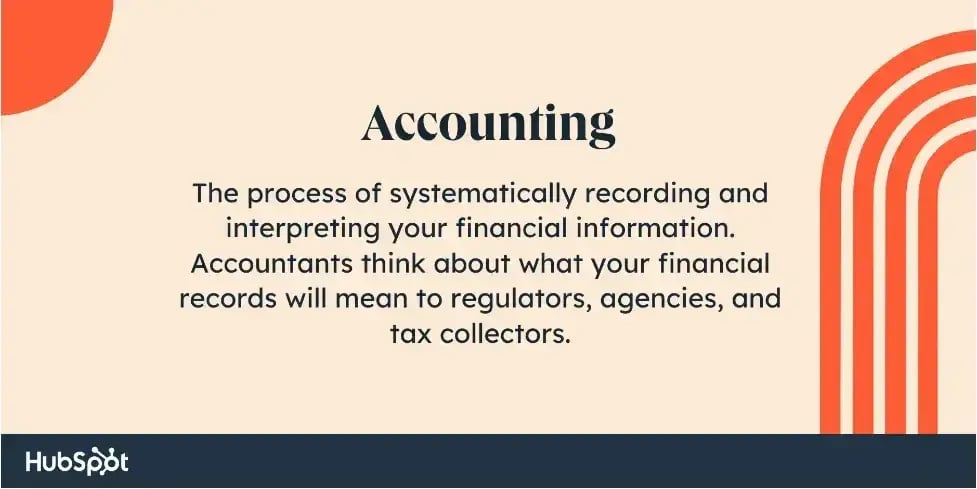

What is accounting?

Accounting is the process of systematically recording and interpreting your financial information. That includes summarizing spend, seeing where revenue comes from, and reporting transactions. Like many careers, accounting is a mix of tactical and analytical tasks. Accountants think about what your financial records will mean to regulators, agencies, and tax collectors.

I like to think of accounting as the backbone of any successful business, especially when it comes to sales. It provides the data showing whether the deals you’re closing are profitable — and whether you’re getting paid fast enough to keep your cash flow healthy.

Through careful analysis and reporting, accounting turns raw financial data into actionable insight, guiding not just operations and planning, but pricing, commission structures, and sales strategy, too.

What is business accounting?

Business accounting involves recording transactions and analyzing finances. It’s a means to gain insights into cash flow, profitability, and overall financial performance.

For sales professionals and business owners, accounting helps connect the dots between revenue targets and real-world outcomes. It shows which products or services are most profitable, where discounts start to hurt margins, and how payment terms affect your ability to reinvest in growth.

How Accounting Shows Up in Sales

You might not think about accounting when you’re negotiating with a client or chasing a quota — but it’s in the background of almost every sales decision.

Here’s where it quietly plays a role:

- Pricing deals. Understanding unit costs and margins helps you avoid underpricing and eroding profitability.

- Structuring payment terms. Whether you offer net-30 or upfront payments affects cash flow projections and working capital.

- Commission planning. Sales commissions are an expense that has to be accounted for correctly — especially with tiered or deferred payouts.

- Discount approvals. Accounting data helps determine when a discount makes financial sense — and when it cuts too deep.

- Forecasting. Sales forecasts feed into revenue projections, which accounting uses to budget for hiring, marketing, and inventory.

- Evaluating customers. Analyzing accounts receivable can surface patterns — like which types of clients pay late or default — so sales can prioritize more reliable accounts.

- Deal reviews. Before finalizing a large contract, finance and accounting often review the terms to make sure the deal supports the company’s financial goals.

Rather than being limited to behind the scenes, accounting shapes how you and your team evaluate, close, and support deals.

Types of Accounting

Accounting is more than staring at balance sheets all day. It shows up in how you price a deal, offer a discount, or decide which clients are worth pursuing. There are different types of accounting that support different parts of the business — and as someone who sells and delivers, I’ve learned to lean on all of them in small ways.

Below, I’ll walk through the types of accounting you might encounter and how they can directly support smarter selling.

Tax Accounting

Tax accounting involves maintaining and keeping track of your business’s taxes. This can include filing yearly taxes, tracking spend and tax rates, as well as assisting employees with setting up tax forms.

Where this comes up in sales: I’ve had to factor in local sales tax and VAT compliance when selling to international clients, especially in SaaS. Understanding how different jurisdictions treat digital services helps avoid surprise liabilities later. If you’re quoting prices across borders, tax accounting isn’t optional — it’s foundational.

Financial Accounting

Financial accounting focuses on the value of the company’s assets and liabilities. These accountants make sure that a company’s accounting follows the Generally Accepted Accounting Principles (GAAP), which I’ll describe below. They also work with cash flow statements and balance sheets.

In sales, this is what helps you understand what kind of revenue is truly profitable. I once closed a large deal that looked great on paper — until I realized how much of it was being eaten up by platform fees, contractor costs, and unpaid client invoices. Financial accounting helped me see the real value of that deal.

Management Accounting

Management accountants present financial data to stakeholders and senior leadership at a company. They play a greater role in reviewing what products or services a company needs, as well as how these efforts can be financed.

From a sales lens, this is the group that asks: Are we selling the right thing at the right price to the right people? If I’m pitching a new offer, the numbers from management accounting help me back up the business case. It’s less about what sounds good and more about what actually holds up financially.

Forensic Accounting

If forensics brings up images of NCIS crime scenes, your deductive skills are up to par! Forensic accounting does require a certain degree of digging and detective work.

This type of accountant investigates and analyzes financial information for businesses. Think compliance breaches or shady contract clauses. I once had a deal fall through because the client’s team flagged an irregularity in our pricing model. A forensic-style review saved us from rolling out a flawed system to future clients.

Cost Accounting

Cost accountants create a constant record of all costs incurred by the business. This data is used to track where the company spends and to improve the management of these expenses. Cost accountants are responsible for finding redundancies and places where the company could cut costs.

This is where you sharpen your pricing instincts. Early on, I priced a fixed-scope project too low because I didn’t account for how many revisions it would realistically require. Once I reviewed the real costs (time, tools, subcontractor input), I built margin buffers into all future quotes. Cost accounting taught me to protect my margins without guessing.

Auditing

Auditors are accountants who specialize in reviewing financial documents to see if they comply with tax laws, regulations, and other accounting standards. These professionals evaluate organizations’ financial documents to make sure that they are accurate and follow legal guidelines.

For sales teams, auditors can feel like the last line of defense. If you’re closing enterprise deals, especially with public companies, be prepared to provide compliant paperwork — pricing breakdowns, historical revenue data, even commission policies. Auditors don’t just review your numbers — they sometimes determine whether the deal moves forward.

International Accounting

International accountants focus on working with businesses that operate around the globe. They know about trade laws, foreign currency rates, and the accounting principles of other countries.

When I started working with clients in the E.U., I had to adjust how I invoice, apply taxes, and account for exchange rate fluctuations. International accounting helped me ensure I was quoting and collecting the right amount — and not losing money in the conversion process.

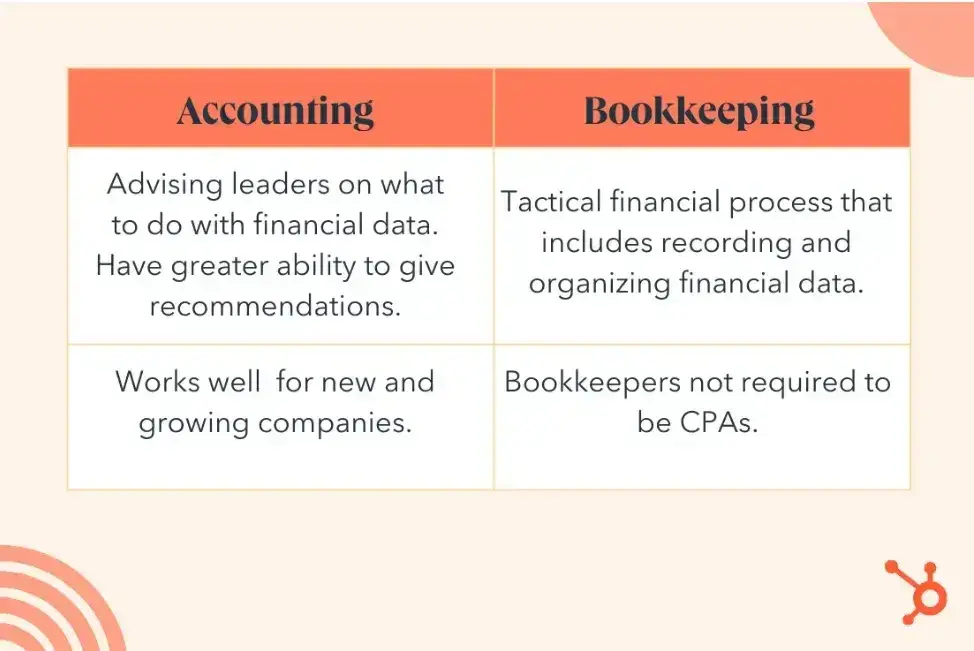

Bookkeeping

Bookkeeping is a tactical financial process that includes recording and organizing financial data. That includes what’s being spent and what money the business is making. This work can be done either by an accountant or a bookkeeper. Bookkeepers focus on tracking spend. Accountants go beyond, advising leaders on what to do with this data.

For sales, bookkeeping helps you answer key questions: Which client hasn’t paid? How much recurring revenue do we actually have? What percentage of closed deals end up canceled or refunded? Before I make any sales push or launch a new offer, I look at the books. Otherwise, I’m building a strategy on assumptions.

The simplest explanation still holds: An accountant can be a bookkeeper, but not all bookkeepers are accountants. But when you’re in sales, either one can help you close smarter.

The Importance of Accounting in Sales

Sales directly impacts your margins, cash flow, and long-term profitability. Accounting knowledge helps you understand how deals affect the bottom line, so you sell more strategically and build a healthier business.

Improves Pricing Decisions and Deal Profitability

When you understand your cost structure, margins, and overhead, pricing stops being a guessing game. Accounting helps you see which products, pricing models, or discounts are actually making money and which are quietly eroding your margins.

According to McKinsey, top-performing B2B companies that use data and analytics to inform sales strategies see a 2% to 5% increase in sales.

Why? Because they make pricing and deal decisions based on facts, not gut feel. By tracking cost-to-sell by channel, product, or customer, you can structure smarter offers, negotiate more confidently, and protect your bottom line with every deal you close.

Leads to Better Customer Understanding Through Revenue Data

Understanding your revenue data is a lens into customer behavior. By looking at where your income is coming from, which products are repeatedly purchased, and which customers are the most profitable over time, you see patterns that can shape your entire sales strategy.

Marty Bauer, director of sales and partnerships at email marketing platform Omnisend, puts it well: “The reason for understanding accounting is that any good salesperson or customer-facing role in general must be able to put themselves on the same side of the table with the customer. By understanding the customer’s position and business needs — most of which run through accounting — you can be more adaptive to the customer’s needs.”

That perspective shift is powerful. Revenue data tells you what matters most to your customers — not just what they buy, but how and when they buy it. It helps you personalize conversations, anticipate objections, and position your offer as a smarter business decision.

Helps Forecast More Accurately and Manage Sales Cycles Smarter

Accurate forecasting starts with knowing your actual costs, cash flow patterns, and historical sales performance. Accounting gives you the inputs to build forecasts grounded in reality, not guesswork. For example, if your financial data shows that Q3 consistently brings in 30% of annual revenue, you can plan your outreach, hiring, and ad spend accordingly.

It also sharpens how you manage your sales cycle. When you know your average cost to acquire a customer, your average deal margin, and how long it takes to close, you can prioritize high-impact deals and avoid chasing leads that burn time without delivering profit. Accounting turns your pipeline into a business tool, helping you align revenue targets with actual financial outcomes so your sales strategy scales with stability, not just speed.

Essential Accounting Concepts

If you’re an aspiring entrepreneur, running a small business, or leading sales in your own company, here’s an overview of how accounting underpins the work you do. It starts with this conceptual understanding: Accounting is to financial management what a foundation is to a building.

It’s what tells you if your sales are actually profitable — not just impressive on paper.

Accounting helps you keep track of three important things:

- Tracking income and expenses.

- Ensuring compliance with the regulatory side of finances and tax laws.

- Making informed decisions that drive growth.

Whether you’re handling finances yourself or working with a bookkeeper, these phrases will come up. Understanding the language makes you sharper when pricing, forecasting, or evaluating a deal. These 24 terms will create the foundation on which you’ll build your knowledge.

Some may not apply to your business right now, but if you’re planning to grow or shift into higher-value deals, you’ll want a holistic view.

1. Debits & Credits

Not to be confused with your personal debit and credit cards, debits and credits are foundational accounting terms to know. I remember the difference like this:

A debit records the money coming into my business. A credit records the money going out.

Let’s say I invoice a client for a consulting package. The revenue that hits my account? Debit.

Now say I pay a contractor to help me fulfill that project. That payment? Credit.

When you operate out of a cash account — a business bank account holding your liquid assets — every transaction is recorded using this method.

For example, if I pay for ad spend out of pocket, the cash account is credited (money is leaving), and the advertising expense is debited (to reflect the cost incurred).

Why does this matter for sales? Because understanding how every quote and expense gets logged helps you avoid pricing errors, underestimating delivery costs, or burning through cash without realizing it.

Here’s a simple visual to help you understand the difference between debits and credits:

|

Debits |

Credits |

|

Increase assets |

Decrease assets |

|

Decrease liabilities |

Increase liabilities |

|

Decrease revenue |

Increase revenue |

|

Increase the balance of expense accounts |

Decrease the balance of expense accounts |

|

Decrease the balance of equity accounts |

Increase the balance of equity accounts |

2. Accounts Receivable & Accounts Payable

Accounts receivable is money that people owe you for goods or services. It’s considered an asset on your balance sheet — because it’s money you’re expecting to come in.

In sales, this is your open invoices. If I send a client a $3,000 invoice for a project, that full amount shows up under accounts receivable. When the client pays, the balance goes down. If they delay payment, it stays open — and potentially affects my cash flow. This is why knowing your average collection time matters. It’s not just about closing the deal — it’s about getting paid.

Accounts payable, on the other hand, is money you owe other people. It’s a liability on your balance sheet.

Say I pay $5,000 in rent each month for a co-working space where I meet clients and host workshops. Before I actually transfer that money, the $5,000 is listed under accounts payable — it reflects the upcoming expense.

Both of these matter when you’re running sales and operations. If your accounts receivable keeps growing but your cash isn’t moving, it’s a sign that your collections process (or your client screening) needs work. And if your payables outpace your income? Time to rethink your pricing or spending.

|

Date |

Account |

Debit |

Credit |

|

7/31/24 |

Rent |

5000 |

|

|

7/31/24 |

Accounts Payable |

5000 |

Once that value is paid, here’s how that would be recorded in your company’s financial records.

|

Date |

Account |

Debit |

Credit |

|

8/1/24 |

Accounts Payable |

5000 |

|

|

8/1/24 |

Cash Account |

5000 |

3. Accruals

Accruals are credits and debts that I’ve recorded but haven’t actually received or paid out yet. For example, if I close a deal and send the invoice, I record that sale before the payment hits my account.

Same goes for expenses — I might hire a contractor for a project and log the cost even though I haven’t paid them yet.

This matters for sales because it gives you a more accurate picture of your income and expenses in real time, not just when the money moves. (I’ll explain more when I break down accrual method accounting later.)

4. Assets

Assets are everything your business owns — whether physical or not.

For me, assets include my laptop, design software subscriptions, some intellectual property, and the cash in my business account.

As a sales rep or business owner, it’s helpful to understand what counts as an asset because it affects how you evaluate the financial health of your business — and how much runway you have to invest in lead gen, tools, or people.

5. Balance Sheet

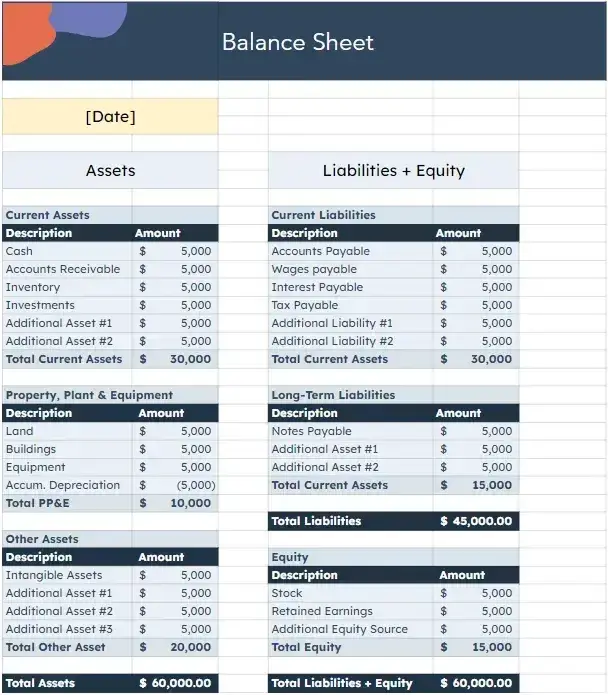

A balance sheet shows your assets (what you own), liabilities (what you owe), and equity (what’s left over) at a specific point in time.

I use it to quickly see where my business stands financially.

If you’re closing deals and bringing in revenue, great — but the balance sheet will tell you whether that’s translating into growth or just covering debt. Especially helpful if you’re thinking about hiring, raising prices, or investing in tools to scale.

6. Burn Rate

Burn rate is how quickly you’re spending money.

Let’s say I make $15K/month from sales but spend $12K to deliver, advertise, and manage operations. By calculating burn rate, I can measure how much I’m really keeping — and how long I can keep operating at that pace without extra income.

It’s a reality check. You might be crushing your quota, but if your burn rate is too high, you won’t feel the results in your bank account.

7. Capital

Capital is the money you have access to for growing your business.

Not the stuff tied up in tools or inventory — just cold, usable cash. For me, that’s what I use to run LinkedIn ads, buy tech, or bring on support when my pipeline gets full.

If you’re in sales, capital helps you stay agile: test offers, take bigger swings, or ride out slow periods without panic.

8. Cash Flow

Cash flow tracks the money moving in and out of your business over a period of time.

Say I close $10K in deals this month, but one client pays late and another asks for net-30 terms. Meanwhile, my $8K in monthly expenses are still due on time.

Even though it looks like I’ve made money, I might still struggle to cover expenses. That’s the cash flow gap — and it’s why so many sales reps and solopreneurs feel broke despite good revenue.

Watching this number closely helps you manage timing, plan smarter, and avoid cash crunches.

9. Chart of Accounts

The chart of accounts (COA) is something that can be used as a master list of all the accounts in my organization’s general ledger. It’s like a roadmap that helps me organize and categorize every financial transaction, making it easier to track and manage the company’s finances.

The COA includes five main types of accounts: assets, equity, expenses, liabilities, and revenues. For example, when I log revenue from a closed deal, or track commission payouts, I refer to the COA to record the transaction in the right spot. It keeps my sales-related activity aligned with the rest of my financial data.

10. Cost of Goods Sold

The cost of goods sold (COGS) or cost of sales (COS) is the cost of producing the product or delivering the service.

COGS or COS is the first expense you’ll see on your profit and loss (P&L) statement and is a critical component when calculating your business’s gross margin. For sales, this tells me how much each deal is really worth after subtracting what it costs to fulfill.

In my opinion, reducing your COGS is one of the best ways to increase your profit — especially helpful when sales stay steady but you want to grow what you keep.

11. Depreciation

Depreciation refers to the decrease in an asset’s value over time. It’s important for tax purposes, as larger assets that impact the business’s ability to make money can be written off based on their depreciation.

For example, if I purchase a laptop that I use to deliver sales-related work, I don’t expense the full cost upfront. Instead, depreciation spreads that cost over the asset’s useful life — lowering my tax burden without distorting my monthly profit.

12. Diversification

Diversification is a risk-management strategy that helps avoid putting all my financial eggs in one basket.

By spreading my investments across different areas, I reduce the risk of losing too much if one stream dries up. As a seller, that includes income streams too — mixing short-term projects, retainers, and upsells helps me stay more stable even if a single client exits.

13. Equity

Equity refers to the amount of money invested in a business by its owners. It’s also known as “owner’s equity” and can include things of non-monetary value, such as time, energy, and other resources.

I like to remember equity as the difference between my business’s assets (what I own) and liabilities (what I owe). A business with healthy equity signals long-term viability — something that matters if you’re looking to raise money or sell down the line. Investors and analysts also look at your business’s EBITDA, which stands for earnings before interest, taxes, depreciation, and amortization.

14. Expenses

Expenses include any purchases you make or money you spend to generate revenue. Expenses are also referred to as “the cost of doing business.”

There are four main types of expenses:

- Fixed. Things like CRM tools or subscriptions I use every month.

- Variable. Costs like paid ads or shipping that change with how much I sell.

- Accrued. A service I’ve received but haven’t paid for yet.

- Operating. Day-to-day costs like internet, software, or coworking space.

When I track expenses closely, I can make sure sales activity is profitable — not just bringing in revenue but actually contributing to the bottom line.

15. Fiscal Year

A fiscal year is the time period a company uses for accounting. Your company determines the start and end dates of your fiscal year. Some coincide with the calendar year, while others vary based on when accountants can prepare financial statements.

For me, knowing my fiscal year helps align sales goals with reporting periods. For example, I plan contract renewals and new offers around Q4 because clients often spend leftover budgets then — it’s a timing advantage worth using.

16. Gross Margin

Your gross margin (or gross income) is your total sales minus your COGS — this number indicates your business’s sustainability.

If I land a $5,000 deal but it costs me $2,000 to fulfill, my gross margin is $3,000.

The higher the gross margin, the more room you have to reinvest in growth, take on riskier deals, or handle slower months. It’s one of the clearest indicators of how well your sales translate into real income.

17. Income Statement

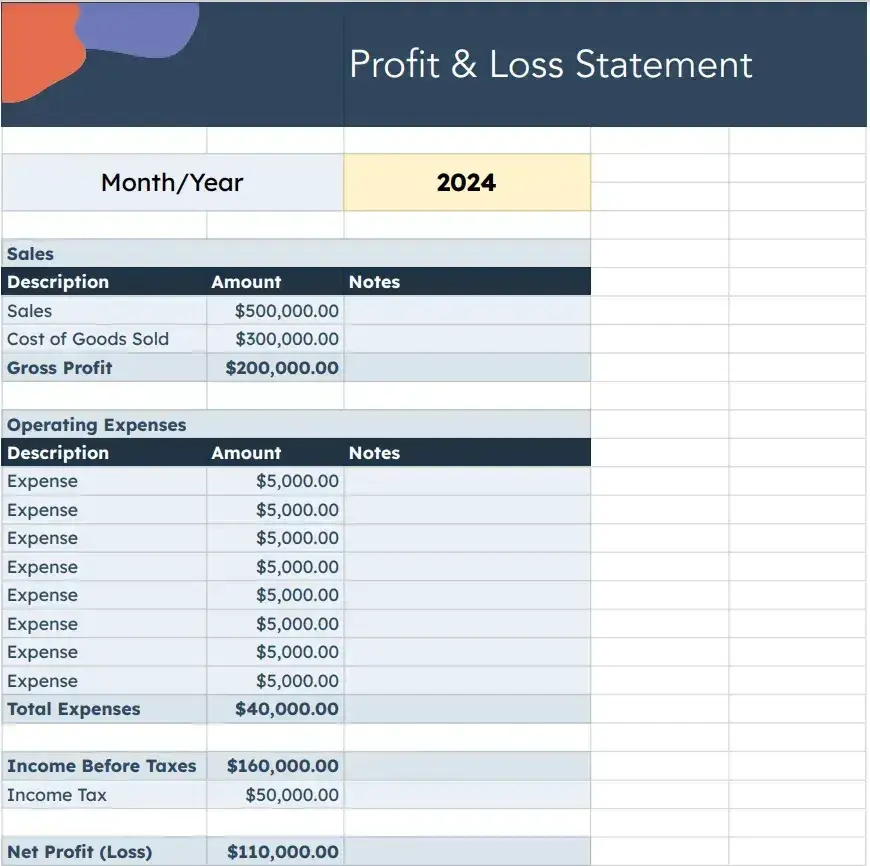

An income statement, also referred to as a profit and loss (P&L) statement, is a financial document I use to see how much my business has earned and spent during a specific accounting period.

It shows me total revenue, subtracts all expenses, and helps me determine whether I made a profit or a loss.

For example, if I earned $50,000 in revenue over a quarter and spent $30,000 delivering that work, my income statement shows a net profit of $20,000.

This document gives me the clearest snapshot of whether my selling strategy is actually working — or just keeping me busy.

18. Inventory

Inventory refers to the assets my company holds with the intention of selling them through our operations.

This could include finished goods, materials in production, or raw components.

In a service-based business like mine, inventory shows up in digital form — like pre-made templates, training materials, or productized offers. Tracking inventory helps me stay aware of what’s sellable, scalable, and ready to go.

19. Liabilities

Liabilities are everything your company owes in the short or long term. This could include a credit card balance, payroll, taxes, or a loan.

When I invest in a sales tool or take out a line of credit to fund a new campaign, it’s a liability until I pay it off.

Keeping tabs on liabilities helps ensure that new sales don’t just mask growing debt — it keeps your growth healthy.

20. Profit

In accounting terms, profit — or the “bottom line” — is the difference between income, COGS, and expenses (including operating, interest, and depreciation).

You (or your business) are taxed on net profit, so I think it’s important to plan for that proactively.

I do this by checking my monthly profit, setting aside a portion of revenue in a separate savings account, and paying estimated taxes quarterly — just like a full-time employer would withhold.

21. Return on Investment (ROI)

Return on investment, or ROI, is a metric used to measure the profitability of an investment, usually expressed as a percentage.

To calculate ROI, divide net profit from the investment by its initial cost, then multiply by 100.

If I spend $500 on LinkedIn ads and close $2,000 in deals from those leads, my ROI is 300%.

Tracking ROI helps me double down on what works — and walk away from what doesn’t — especially when it comes to paid outreach, software, or team support.

22. Revenue

Your revenue is the total amount of money collected in exchange for goods or services before any expenses are taken out.

For anyone in sales, this is your top-line number — the total brought in from closed deals, product sales, or service packages. It’s not profit, but it’s often the first number clients and stakeholders care about when measuring sales performance.

23. Trial Balance

A trial balance is a report used to check the balances of all the accounts in my general ledger at a specific point in time. I usually prepare a trial balance at the end of a reporting period to make sure that everything adds up correctly before finalizing my financial statements.

For example, if I’ve recorded transactions from multiple sales channels — like product sales, retainers, and ad spend — I’ll generate a trial balance to confirm the totals. If debits and credits match, I know the books are balanced. If not, it signals an issue I need to correct before reporting on overall sales performance.

24. Variable Costs

Variable costs are expenses that fluctuate based on the amount of goods my business produces or sells.

Even in a service business, I see this when a new deal requires additional subcontractor support, usage-based software, or ad spend to fulfill.

For example, if I sell a course and have to pay transaction fees and scale email software as enrollment grows, those are variable costs — they increase directly with volume. Keeping an eye on these helps me price services and manage delivery without cutting into margins.

Accounting Principles for Sales Success

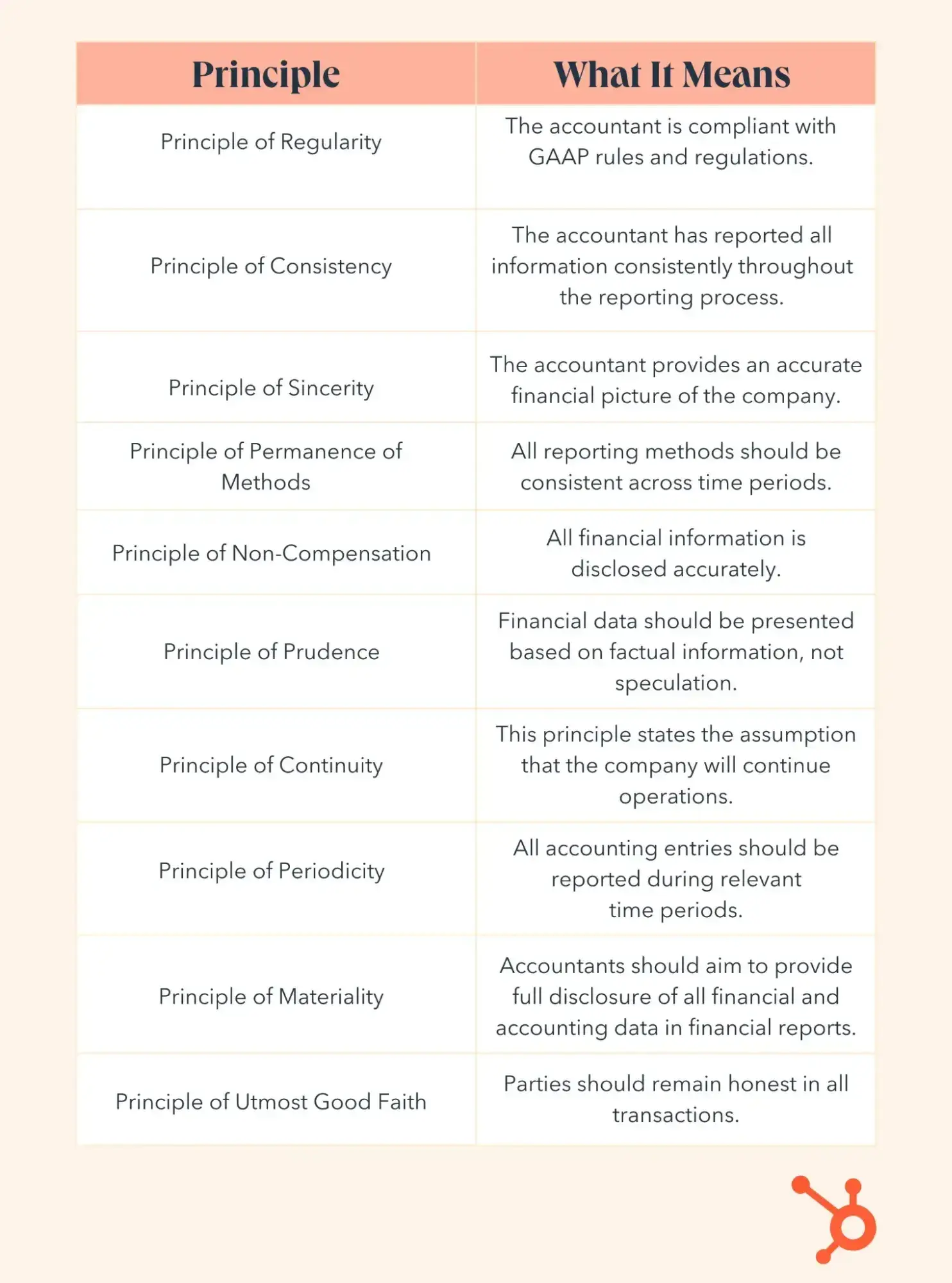

The Generally Accepted Accounting Principles (GAAP) are a blueprint for accounting across sectors in the U.S. These principles confirm that publicly traded companies share their finances accurately.

By law, accountants for all publicly traded companies must comply with GAAP. But even if you’re not publicly traded, these principles help keep your sales, revenue, and reporting consistent and credible.

Let’s break down these principles.

1. Principle of Regularity

The working accountant is compliant with GAAP rules and regulations.

Why this matters: This sets the standard for how finances should be managed. Without it, every company would track sales and income differently, making it hard to compare performance or evaluate potential partnerships.

How to apply: Stick to established Financial Accounting Standards Board (FASB) regulations rules even as a solopreneur. It builds trust with stakeholders, especially if you’re negotiating long-term contracts or enterprise deals.

2. Principle of Consistency

This principle states that the accountant has reported all information consistently throughout the reporting process. Any changes in financial data must be clearly stated.

Why this matters: If I record revenue one way in Q1 and change the method in Q2, it becomes hard to track performance over time. Stakeholders — including potential clients — can’t rely on your numbers if your reporting shifts constantly.

How to apply: Build a consistent process for recording closed deals, expenses, and commissions — and stick to it.

3. Principle of Sincerity

The accountant provides an accurate financial picture of the company.

Why this matters: This principle builds trust. If you’re selling a product or service and your numbers are inflated or unclear, you risk damaging long-term relationships.

How to apply: Keep your financial records honest and up to date. Even if the numbers aren’t what you hoped, accuracy is what matters in the long run.

4. Principle of Permanence of Methods

All financial reporting methods should remain consistent over time.

Why this matters: Sales revenue, pricing models, and even commission structures should follow a clear, repeatable framework. If your reporting changes every time you tweak an offer, your data becomes unreliable.

How to apply: Create a standardized system for sales tracking and expense logging, and use it across all time periods.

5. Principle of Non-Compensation

All financial information — positive and negative — should be disclosed accurately, without adjusting reports to offset losses with gains.

Why this matters: This sounds straightforward, but accounting can impact both internal and external opinions. You can’t just hide slow months behind one big win. Sales can be seasonal or unpredictable, and honest reporting gives a clearer view of what’s working.

Because of this, many publicly traded companies report both GAAP and non-GAAP income. Sometimes, this extra data can help the public image of a company or clarify the value of a company’s investments.

How to apply: Track both your wins and your setbacks without masking one with the other. This helps you make better sales decisions over time.

6. Principle of Prudence

Financial data should be presented based on facts — not speculation.

Why this matters: Sales forecasting is useful, but it shouldn’t be treated as guaranteed income. Overstating expected sales or underestimating expenses can create serious problems.

How to apply: Keep forecasts grounded in real data. Don’t count a sale until it’s closed and the money is in your account.

7. Principle of Continuity

This principle assumes that the company will continue operating in the foreseeable future.

Why this matters: It affects how you value assets and plan future sales strategy. If you assume the business will keep running, you avoid inflating short-term decisions.

How to apply: Create sales and financial plans based on long-term goals — not just short-term wins.

8. Principle of Periodicity

All accounting entries should be reported during their relevant time periods.

Why this matters: This keeps your reporting clean and allows you to measure progress accurately. For salespeople, that means attributing income and expenses to the month or quarter they actually happen in — not when you feel like logging them.

How to apply: Set a fiscal calendar and stick to it — monthly, quarterly, and annually.

9. Principle of Materiality

Accountants should provide full disclosure of all financial data — but they don’t need to report every tiny transaction if it’s not significant.

Why this matters: If you sell a $10K project, the $3 spent on a stock photo doesn’t need a line item. But a $1,000 contractor invoice probably does.

How to apply: Decide what’s “material” based on your sales volume. As you grow, revisit your threshold for what deserves individual tracking.

10. Principle of Utmost Good Faith

All parties should act honestly and share all relevant information when entering a financial agreement.

Why this matters: This principle builds trust in sales negotiations. Clients want to know that the deal they’re entering is based on full transparency.

How to apply: Be upfront about pricing, deliverables, and terms — especially in your proposals and contracts. It’ll save you from misunderstandings later.

Essential Financial Documents

Regardless of how you manage your business accounting, it’s wise to understand the core financial documents. I like to think of it this way: If I can read and prepare these basics, I’ll understand how my sales efforts are actually translating into business performance, and that lets me make smarter financial and strategic decisions.

Here are the key accounting documents and calculations I recommend getting familiar with even if you work with a CPA or use accounting software. These give you valuable insight into how well your business is selling, spending, and sustaining itself.

1. Profit and Loss (P&L) Statement

A profit and loss (P&L) statement summarizes your business’s income and expenses during a set period — monthly, quarterly, or annually.

This is especially useful when reviewing client profitability, seasonal trends, or planning for estimated taxes. Your P&L is also used to fill out your Schedule C tax document if you’re a sole proprietor.

I use this statement to double-check that my sales growth is actually translating into real profit — and not being eaten up by rising costs.

2. Balance Sheet

A balance sheet is a snapshot of the business’s financial standing at a specific point in time.

It shows assets, liabilities, and equity — including retained earnings, or how much profit has been reinvested into the business.

If you’re scaling through sales, this document helps you assess whether your growth is sustainable or just temporarily padded by short-term wins.

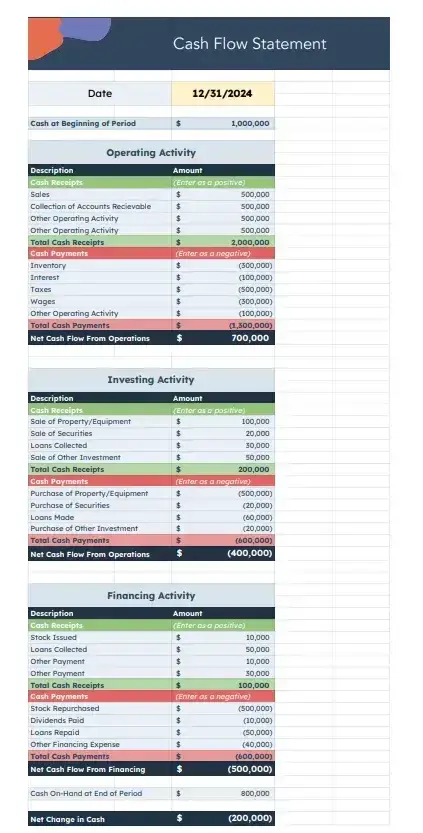

3. Cash Flow Statement

A cash flow statement analyzes how and where you’re receiving and spending money. It breaks things down into operating, financing, and investing activities.

This helps you catch cash gaps — when the timing of your revenue and expenses gets out of sync.

I’ve had months where my income looked great, but a few late payments left me scrambling. Cash flow reporting helps prevent that.

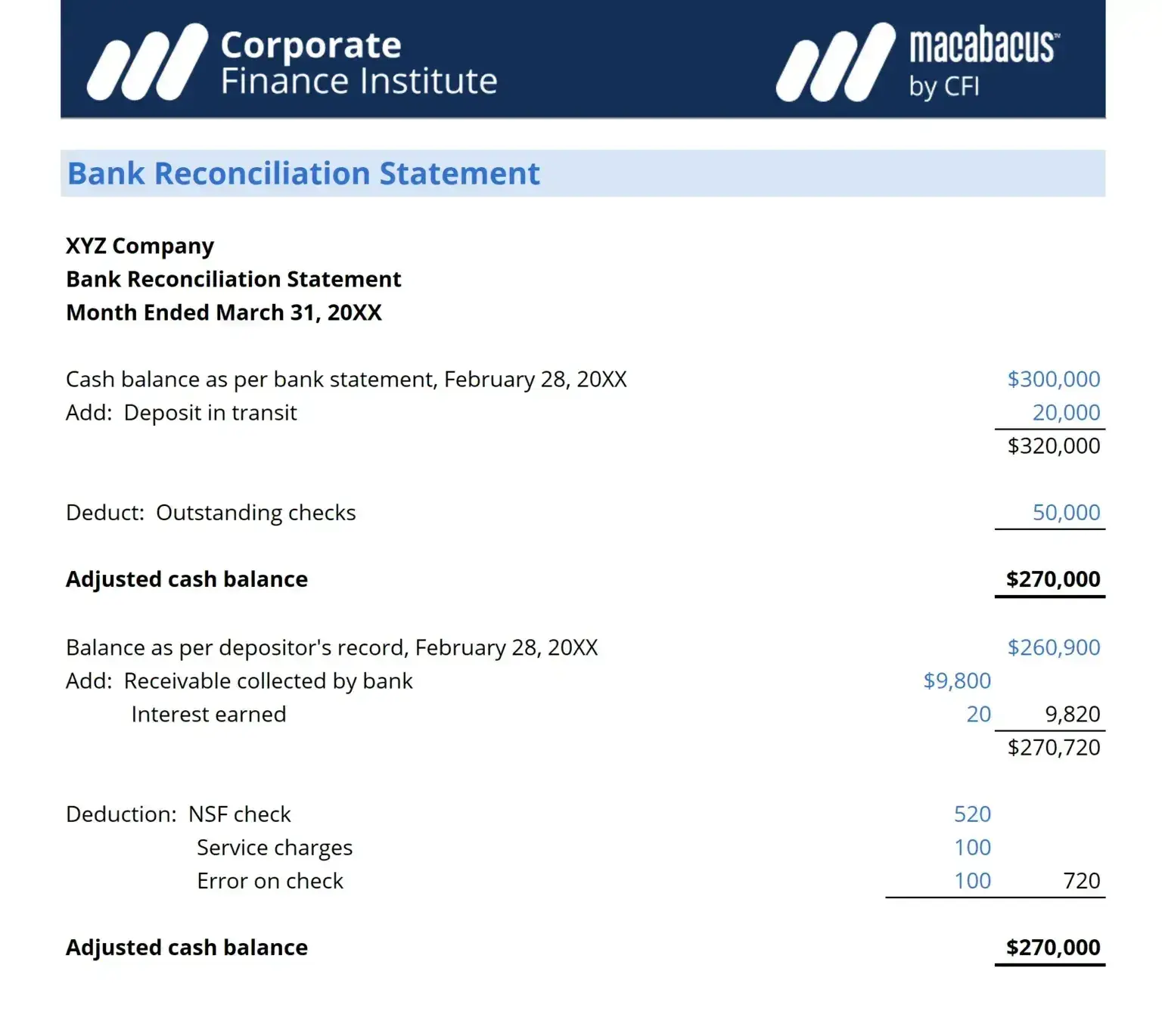

4. Bank Reconciliation

A bank reconciliation compares what your accounting records show with what’s actually in your bank account.

It’s the process of confirming that every transaction in your records matches what cleared through the bank.

For anyone making regular sales, receiving payments, or handling recurring expenses, this process helps you catch errors, missed payments, or duplicate charges — before they snowball.

Accounting Skills for Sales-Led Professionals

Being great at accounting isn’t just about spreadsheets or tax codes — it’s about understanding how money flows through your business and using that insight to make better sales and pricing decisions.

And even if you don’t want to become a full-fledged accountant, having a working knowledge of the key accounting skills can help you make more strategic decisions, avoid common mistakes, and keep more of what you earn.

Here are the core skills that make a difference, especially if you’re in charge of both bringing in revenue and managing it.

Listening

If you’re hiring an accountant or a bookkeeper, you want someone who listens to how your business runs, where your expenses come from, and what your revenue goals look like.

If you’re managing your own books (like many of us do at first), you need to listen, too — to what your numbers are trying to tell you. High revenue with low margin? Late-paying clients? Seasonal dips? That all shows up in your financial data first.

Time Management

Similar to any other profession, time management is an essential skill to have. An accountant is often faced with internal deadlines and audits. Plus, reviews of your financial health need to be completed in a timely way.

If you wait too long to track income, file taxes, or send invoices, it creates stress — and sometimes penalties.

Just like you manage your pipeline and follow-ups, build routines to review your finances regularly. Block time for monthly reviews, quarterly estimates, and tax prep. It’s way easier than trying to play catch-up under pressure.

Organization

Whether you’re tracking commissions, reimbursable expenses, or client payments, organization is essential.

I keep digital folders for receipts, use tags in my inbox for invoices, and sync all payments through one tool so nothing gets missed.

If you’re working with a contractor or VA, setting up a clear system for storing and sharing financial docs can save you both time — and protect your data.

Critical Thinking

As your business grows, so do the decisions. Should you raise prices? Hire help? Cut a service that’s high effort, low return?

Your numbers will often point you in the right direction — but only if you know how to interpret them. That’s where critical thinking comes in.

Being able to spot patterns, analyze spend, and adjust based on what the data shows can keep your business healthy, even when sales fluctuate.

Whether you’re a solo seller, consultant, or founder who just launched a startup and wearing the sales hat, you already know how much of your business hinges on closing deals. But getting paid is only part of the equation — what you do with that revenue is what determines whether you’re building a business or just chasing cash flow.

I’ll walk you through eight key steps to get your financial foundation in order, with a clear focus on sales-driven businesses. These are systems that protect your income, make tax season easier, and let you scale without second-guessing your numbers.

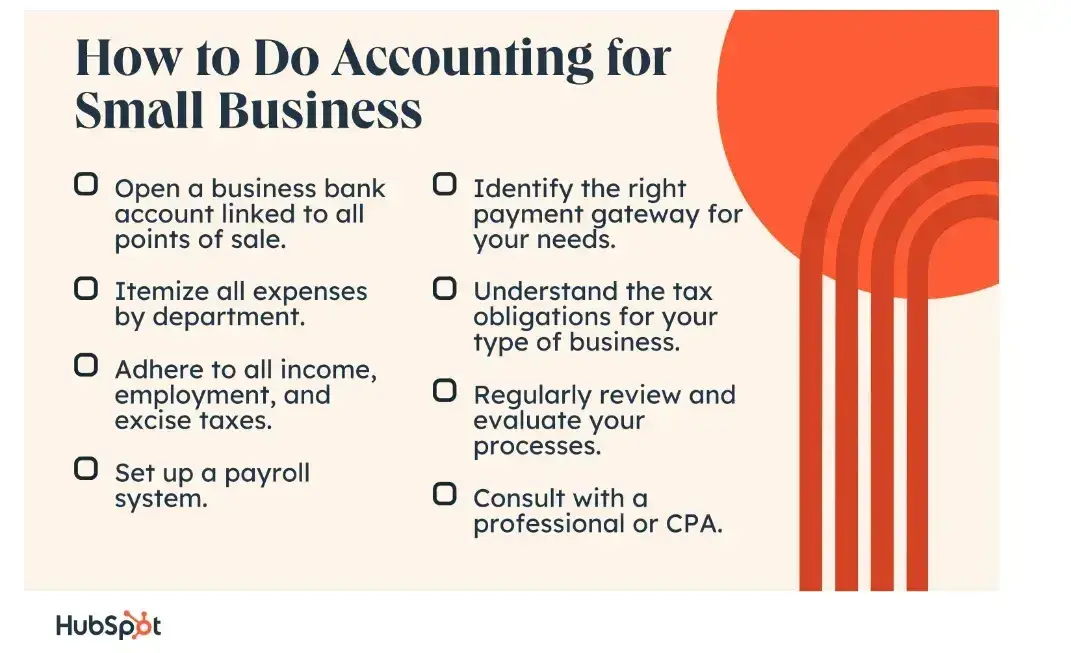

1. Open a business bank account linked to all sales channels.

If you’re selling anything — services, courses, retainers, even one-off projects — step one is separating your business and personal finances.

When Stripe, PayPal, and your CRM start syncing payments, you’ll want everything flowing into one clean business account. That way, when a client asks for a report or you’re prepping a proposal, you don’t have to dig through personal Amazon charges to find it.

Even if you’re a sole proprietor and not required to have a separate account, I highly recommend it. It makes reconciling invoices easier and helps you avoid messy bookkeeping later.

What I do:

- One checking account for incoming payments and everyday spend.

- One savings account for taxes and emergency expenses.

- One business credit card to build credit and smooth out project-related spend (think ad campaigns or travel).

If you ever scale to an LLC or S-Corp, having these in place also makes it easier to show business legitimacy for tax or legal purposes.

Look for a bank that has a local branch as well as robust online banking. Also, be sure the bank can integrate with your point-of-sale (POS) system and other technological needs. Business bank accounts typically charge more than personal accounts and often have a higher minimum balance. Check these numbers before committing to a bank and a business account.

2. Track every expense tied to your selling activity.

When people say “write it off,” what they really mean is: Track it properly so the IRS doesn’t eat your margins.

As someone who runs the sales engine and delivers client work, I’ve learned to stay especially organized with anything tied to prospecting, lead gen, or client fulfillment.

Here are a handful that you should definitely keep a record of. (Why? Because they’re easy to mix up with personal expenses… and the IRS knows it.)

- Client acquisition: CRM subscriptions, LinkedIn Premium, Zoom, Calendly, website hosting.

- Travel for deals: Flights, rideshares, hotels when meeting with clients or speaking at events.

- Sales tools: Proposal software, e-signature tools, productivity apps.

- Marketing: Paid ads, graphic design, contractors for landing pages.

- Client meals: Coffee chats, lunch meetings (yes, these count if business was discussed).

Check out solutions like Rydoo, Expensify, Zoho Expense, and Shoeboxed to help manage your expenses. I use tools like Expensify or even just a folder of tagged email receipts to log this quickly.

And if a client reimburses me for something (like printing materials for a pitch), I always list it separately on the invoice. Why? Because if you don’t separate reimbursable costs from service fees, you’ll end up getting taxed on income that was never really yours.

In case you need to support these expenses, I recommend that you keep the following documents. (Rule of thumb: When in doubt, keep everything.)

- Receipts (paper and digital).

- Bank and card statements.

- Bills (for utilities, phone, internet, etc.).

- Canceled checks.

- Invoices and documents showing proof of payment.

- Financial statements from your bookkeeper or bookkeeping software.

- Tax returns from previous years.

- Any W-2, W-4, W-9, and 1099-MISC forms.

Pro tip: To minimize the risk of slipping up, you can create a standardized invoice template for free with tools like HubSpot’s Invoice Generator.

Another common way to manage your expenses is by separating operating expenses from selling, general, and administrative (SG&A) expenses.

Operating and SG&A Expenses

Some companies decide to combine operating (OPEX) and SG&A expenses, while some separate them (they can be combined on an income statement). Either option is totally fine — it’s about preference.

Here’s what you need to know about OPEX versus SG&A expenses:

- Operating expenses include costs related to your daily expenses and are often the majority of a business’s expenses (which is why many companies choose to combine these expenses).

- OPEX aren’t included in COGS — they’re the costs involved in the production of goods and services such as rent, utilities, insurance, inventory costs, salaries or wages, property taxes, or business travel.

- SG&A expenses are incurred as daily business ops and are included in income statements (under “expenses”).

- SG&A expenses aren’t included in COGS (since they’re not associated with a specific product) and aren’t assigned to your manufacturing costs.

- If separated from OPEX, SG&A covers factors like accounting and legal expenses, ads and promotional materials, marketing and sales expenses, utilities and supplies that aren’t related to manufacturing, and corporate overhead (if there are executive assistants and corporate officers).

If you’re a contractor working with clients that require you to pay money out of your own pocket (for travel, meals, materials, and so on), which they will later reimburse, things get a bit more complicated.

On one side, these costs can count as deductible expenses. On the other hand, the clients pay you for them, along with the actual services you offer, so they’re now income.

Usually, these expenses can still be deductible, but it’s super important your invoices list these reimbursed costs separate from the amount clients owe you for your actual work — you won’t be able to spot these expenses and see whether they’re deductible otherwise.

3. Adhere to all income, employment, and excise taxes.

Ah. If only bookkeeping meant hoarding the paperbacks I overbuy from my local bookstore — I’d be really good at that.

Unfortunately, bookkeeping isn’t always as fun. It’s another important account term that refers to the day-to-day recording, categorizing, and reconciling of transactions. Basically, bookkeeping keeps you from spending and making money without tracking it.

Bookkeeping is an ongoing task. Technically, you should be doing it every day, but we all know life can get in the way. Ideally, you should complete your bookkeeping every month so you can keep a thumb on the pulse of your income, expenses, and overall business performance.

Before I dive into how to do your bookkeeping, let’s cover the two main bookkeeping methods.

Cash Method

The cash method recognizes revenue and expenses on the day they’re actually received or paid. This method is the simplest for small businesses because it doesn’t require you to track payables or receivables and reflects whether or not your money is actually in your account.

Accrual Method

The accrual method recognizes revenue and expenses on the day the transaction takes place, regardless of whether or not it’s been received or paid. This method is more commonly used as it more accurately depicts the performance of a business over time.

The only thing it doesn’t show is cash flow — a business can look profitable but have zero dollars in the bank. If a business’s annual revenue exceeds $5 million, it’s required to use the accrual method.

Now, I’ll talk about how you can do your bookkeeping.

- You could keep your own books with a spreadsheet (like Excel or Google Sheets). Personally, I think this method is best for individuals or small businesses with low budgets. Download a bookkeeping template if you need help structuring your data.

- You could outsource your bookkeeping to a freelance bookkeeper or bookkeeping service.

- You could hire a full-time bookkeeper if your budget and bandwidth allow it.

- You could use bookkeeping and accounting software like Bench, Manager.io, QuickBooks, FreshNooks, or Xero. (Don’t worry — there are plenty of free accounting software options, too.)

4. Set up a payroll system.

If you’re planning to scale your sales efforts by bringing in help, whether that’s a part-time admin, a contractor, or a full-time teammate, you’ll need a system for managing payments.

Even if you’re solo for now, setting this up early keeps your business clean and scalable.

There are lots of tools out there that make payroll easier — Gusto, Zenefits, and Intuit QuickBooks Payroll are solid options that can grow with you.

Employees vs. Contractors (and what it means for taxes):

- Employees. If you bring on an employee to help with outreach, demos, or client delivery, their wages, commissions, benefits, and payroll taxes are deductible. You’ll need to collect a W-4 from them and issue a W-2 at year-end.

- Independent Contractors. This includes virtual assistants, freelance designers, or writers. You don’t withhold taxes or provide benefits. But you’ll need them to submit a W-9 so you have their business information (such as their SSN or EIN), and you’ll issue a 1099 if you pay them more than $600 in a year.

For sales-led teams, the contractor route is more common early on. Just be sure to track all payments and keep copies of forms on file. It’ll save you stress come tax season — and make scaling smoother when you’re ready.

5. Choose the right payment gateway.

Now that we’ve covered how you pay people, let’s talk about how you get paid.

Whether you’re sending invoices, selling a service package, or collecting payments from a storefront or sales page, your payment gateway is how revenue actually hits your account.

For service providers and freelancers:

As a freelance writer, I rarely work with clients in person. In fact, I’ve only ever officially met one of my clients — the rest I work with purely over email. Because of that, I collect most of my payments through an online gateway.

Payment Gateway for Service Provider

PayPal is a popular choice for collecting payments. You can also use software like Wave, Xero, or Bench. Not only can you invoice clients through these programs, but you can also conduct bookkeeping, payroll, and other accounting tasks. These charge fees, though, so consider that when making your decision.

Another way to collect payment is through mobile applications like Venmo or Cash App — just be sure to send an invoice as proof of payment. My least favorite option is collecting payment via check — the reason being that it takes longer than an online transfer. (Send an invoice with this method, too.)

Payment Gateway for Storefront Business

Collecting money in person (at a storefront, marketplace, etc.) can get pricey. Between equipment, credit card fees, and handling physical cash, it can be a hassle. Thankfully, Square and PayPal make it easy to accept card payments using your smartphone or tablet. These programs also send your customers receipts, reconcile your transactions, and handle returns if necessary.

If you expect a high influx of daily purchases, I recommend choosing a more robust POS system and more reliable equipment (like a register and a dedicated card reader).

Both Square and PayPal offer this option, too. With this option, you’ll need to set up a merchant account with your bank. (This account acts as a middle ground between your POS system and main bank account.)

Payment Gateway for Ecommerce Business

Ecommerce platforms like Shopify, BigCommerce, and WooCommerce often provide built-in payment gateways. These are always the easiest to adopt as they’re already integrated with your website. I suggest also checking out third-party payment solutions such as Stripe.

6. Understand your tax obligations.

If you’re closing deals and seeing consistent revenue, taxes aren’t just a box to check — they’re a crucial part of staying profitable.

The good news? You don’t have to be a tax expert. But you do need to know what you’re responsible for, especially as a sales-driven business.

That includes:

- Income tax on your profits.

- Self-employment tax if you’re a solo founder.

- Sales tax, depending on your product/service and where your buyers are located.

- Payroll tax, if you’re paying employees.

Tax planning matters because revenue ≠ income. I set aside 25–30% of every payment I receive, so I’m never surprised by my quarterly estimates. You can use a savings account just for tax funds, or use software like QuickBooks to track automatically.

Also, sales tax laws get complicated fast if you’re selling across states or countries. If you’re unsure whether your services are taxable in a specific state or industry, consult a pro. It’s worth it.

7. Regularly review your financial process.

Salespeople live in dashboards: pipeline, revenue, and activity.

Your accounting deserves the same energy. If you never look at your financial setup, you might miss costly errors, tax issues, or signs you’re overextending.

You don’t need to do a deep dive weekly, but I recommend reviewing your books:

- Monthly, to stay on top of cash flow and expenses.

- Quarterly, to prep for tax payments and adjust goals.

- Annually, to check profitability, plan budgets, and set income targets.

If your business is seasonal (like running Q4 sales pushes or event-based offers), your review cadence should reflect that.

For me, I review expenses monthly and run a bigger report each quarter. It’s become a habit, like reviewing sales performance. The numbers help guide my pricing, marketing, and hiring decisions.

8. Consider working with a CPA or a professional service.

You don’t need to handle all your accounting alone. In fact, if your focus is sales, it’s smart to delegate the parts that pull you out of your zone.

A good CPA or bookkeeping service can:

- Save you time.

- Spot tax-saving opportunities.

- Keep your books clean.

- Help you prep for funding or scaling.

To find someone solid:

- Ask business-owner friends or trusted peers in your niche.

- Use the CPA directory.

- Post in freelancer or founder communities.

- Search local firms and check for industry experience (especially if you’re in SaaS, consulting, or coaching).

Personally, I prefer someone who understands solo operators and sales-driven businesses — someone who doesn’t just file forms but helps me think strategically about growth.

If your budget allows, hiring an in-house bookkeeper can be a game-changer. But even a quarterly check-in with a CPA can make a big difference. Set expectations early around deliverables and communication so nothing gets lost.

How to Integrate Accounting With CRM Systems

Integrating your CRM and accounting system bridges the gap between your front-end sales activity and back-end financial tracking. It gives you a real-time view of how leads, deals, and invoices connect — helping you reduce missed invoices, cut manual entry time, and forecast revenue with fewer surprises.`

Here’s what you need to do:

1. Choose tools that play well together.

Start by confirming that your CRM and accounting platforms support integration. Most popular tools offer native connections or third-party syncs.

- CRM examples: HubSpot, Salesforce, Pipedrive.

- Accounting tools: QuickBooks, Xero, Zoho Books.

- Integration tools: Zapier, Make, native connectors.

HubSpot already offers native integrations with accounting apps like Xero, FreshBooks, and NetSuite, which means you can skip Zapier or Make entirely and connect your data directly — no extra workflows or third-party automation required.

Look for integrations that allow syncing of contacts, invoices, deal values, and payment statuses at a minimum. This lets your sales team see which deals have unpaid invoices, so they don’t chase cold leads while finance chases payments.

2. Map your workflows before connecting anything.

Before flipping on the integration, get clear on what you actually want to sync. Start with questions like:

- When a deal is marked as “Closed Won,” should an invoice be automatically created?

- Should client payment status appear in the CRM?

- Do I want to trigger follow-ups when a payment is overdue?

Mapping this out helps avoid data overload and keeps your systems focused on what matters for sales and accounting. Otherwise, you risk syncing every field, which clutters your CRM with irrelevant data like payment terms or PO numbers.

3. Connect the systems and configure field mapping.

Once you’re ready, connect the tools using either native integration or a platform like Zapier. You’ll be prompted to match fields across systems. This is called field mapping.

For example:

- CRM “Deal Value” → Accounting “Invoice Amount”

- CRM “Contact Email” → Accounting “Client Email”

- CRM “Closed Date” → Accounting “Invoice Issue Date”

Double-check that fields are formatted consistently between tools (like currency or date formats) to prevent sync errors.

4. Test with one client or deal before going live.

Before rolling out the integration across your entire client list, test with a single customer or small deal. Watch how the data flows between systems:

- Does a closed deal trigger the correct invoice?

- Is the client info accurate and up to date?

- Do payment statuses reflect in the CRM as expected?

Fix any misalignments before syncing your full database. One wrong sync could auto-send an invoice to the wrong contact or worse, misreport revenue before tax time.

5. Train your team on how to use the integrated workflow.

If you work with contractors, an assistant, or a sales team, make sure they know how the new workflow works. Define who updates records, sends invoices, or resolves sync issues.

Even if you’re solo, document your process now. It’ll save hours if you ever bring in a bookkeeper or get audited.

This is where HubSpot shines as a CRM tool for accountants and simplifies collaboration across sales, support, and finance. Compile client data in one place, route customer inquiries to the right person, and get easy access to every customer touchpoint — whether it’s tied to a deal, invoice, or ticket. If you’re managing both client relationships and revenue, it’s built to support both sides without added tools.

6. Set up reports and alerts tied to accounting data.

One of the biggest benefits of integration is real-time reporting. Use your CRM dashboards to:

- Track open invoices.

- View revenue by customer or deal source.

- Flag overdue payments.

- Forecast cash based on pipeline.

You can also set alerts when a deal closes, an invoice gets paid, or a payment is late. This turns your CRM into a revenue radar so you can spot cash flow gaps before they hit your bank account.

7. Review and audit regularly.

Even with automation, things break. Set a monthly reminder to review a sample of records to ensure syncing is working properly.

Look for duplicate contacts, missed invoices, or outdated payment statuses, and fix any disconnects before they cause problems at tax time or during client follow-ups.

Learn the Basics to Sell Smarter

Understanding accounting is part of becoming a sharper business owner.

Once you know how to track and interpret your revenue, expenses, and margin, you start making decisions with more confidence. You understand when to reinvest, how to quote projects more profitably, and how to avoid the financial pitfalls that catch so many early-stage sellers off guard.

If you’re using accounting software, these basics help you use it better. And if you’re working with a CPA, they help you ask better questions.

Whether you DIY or delegate, learning the language of accounting gives you more control and makes sure your sales success actually shows up in your bottom line.

Editor’s note: This post was originally published in May 2019 and has been updated for comprehensiveness.

![]()

![How & why to use sales scripts [+ 14 examples and templates]](http://nurseagence.com/wp-content/uploads/2025/07/sales-script-examples-hero-425x283.webp)